PCI-DSS Compliance

Three

years

ago I wrote about PCI-DSS

explaining what it is and what requirements companies have to comply

if they want to store, process or transmit cardholder data. However,

today, I have more knowledge than three years ago about PCI because I

have been working for the banking sector and some companies from then

to try to protect their data. Therefore, I would like to share

and write an overview about this standard.

Obviously,

this standard has increasingly demanding requirements due to the fact

that more and more people are using plastic card to buy online. As a

result, the Payment Card Industry like the major card brands (Visa,

MasterCard, American Express, etc) want to reinforce the requirements

because they are losing money with the last attacks to the systems of

merchants, processors, acquirers, issuers, and service providers.

Consequently, it is mandatory to implement the requirements of

PCI-DSS if you want to work with cardholder data. Until when?

Maybe when all of us have our money in Google

Bank.

Nooo please!!

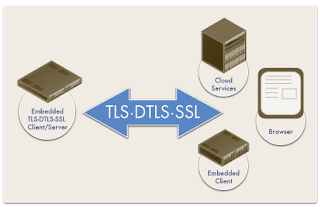

One

of the latest change the council has done into the PCI-DSS standard

has been last April when they released the 3.1 version which doesn't

recommend the SSL libraries because last SSL vulnerabilities like

FREAK,

PODDLE,

Heartbleed

or BEAST

are painful and

dangerous for their pockets. However, policies and procedures like

Security Policy, Change Management Procedure, Incident Response

Procedure or the Security Development Methodology remain important if

we want to protect our data and comply with this standard.

Although documentation is essential and auditors couldn't audit

anything without them, in fact, if it isn't written down, it doesn't

exist, technical controls should be implemented as well. One of the

technical control that more impact to me is how we should encrypt the

cardholder data because we must encrypt the Data Encryption Key (DEK)

with a Key Encryption Key (KEK), they must be store separately and

KEK should be at least as strong as the DEK. The best option to do

this is with an HSM appliance but the cheapest option is to store the

cardholder data and DEK in a server and KEK and master key in another

server. What does all of this mean? We have at least to encrypt the

cardholder data with a key, this with another key store in other

place, and this last key should be encrypted as well. All of this to

protect cardholder data.

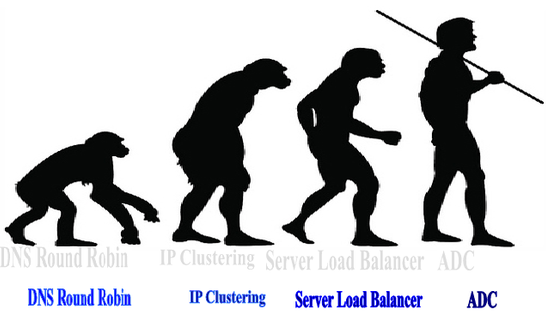

In addition to encryption keys, there are a lot of technical controls

that we should take into account like two factor authentication for

remote access to the PCI infrastructure, penetration

test and vulnerability scan, user management, firewall

installation, network and services segmentation, file

integrity monitoring, IDS/IPS, retention of logs, etc.

Best

regards my friend and remember, if

you have to adapt your

infrastructure to the PCI-DSS standard, you'll have to implement the

12 requirements to protect the most important thing for your

customers, the cardholder data.

Commentaires

Enregistrer un commentaire